News Release

TSX:TLO

Not for dissemination in the United States or to U.S. newswire services

US EV BATTERY SUPPLY CHAIN: TALON SETS AMBITIOUS 2022 EXPLORATION GOALS FOR THE TAMARACK NICKEL PROJECT IN MINNESOTA AND PROVIDES CORPORATE UPDATE

Enhances financial optionality to progress towards a pre-feasibility study while targeting new areas of nickel-copper mineralization to establish ‘district’ status

Tamarack, Minnesota/Road Town, Tortola, British Virgin Islands (December 16, 2021) – Talon Metals Corp. (“Talon” or the “Company”) (TSX:TLO) is pleased to provide an update on the Tamarack Nickel-Copper-Cobalt Project (“Tamarack Nickel Project”), located in central Minnesota.

“Over the last year, our in-house team and drilling assets consistently delivered high-grade nickel-copper mineralization at the Tamarack Nickel Project,” said Brian Goldner, Vice President of Exploration for Talon. “For 2022, we plan to be focussed on progressing the Tamarack Nickel Project towards completion of a pre-feasibility study, while continuing to find new nickel rich areas along the Tamarack Intrusive Complex, with the goal of showing that Tamarack has ‘district’ scale potential.”

Talon has built an in-house team of drillers, geologists, and geophysicists that are all employed by the Company and focussed solely on the Tamarack Nickel Project. The in-house team has the necessary tools to efficiently collect and interpret data and then rapidly test each new exploration hypothesis. These include LF-90 diamond core drill rigs, Bore Hole Electromagnetic (geophysics) survey tooling, Surface Electromagnetic (geophysics) survey tooling, and the recently added Cross-Hole Tomography geophysical equipment. Talon’s multidisciplinary team has been able to significantly reduce the cost of exploration below what would be expected from a traditional exploration program, while simultaneously finding new high-grade massive sulphide mineralization.

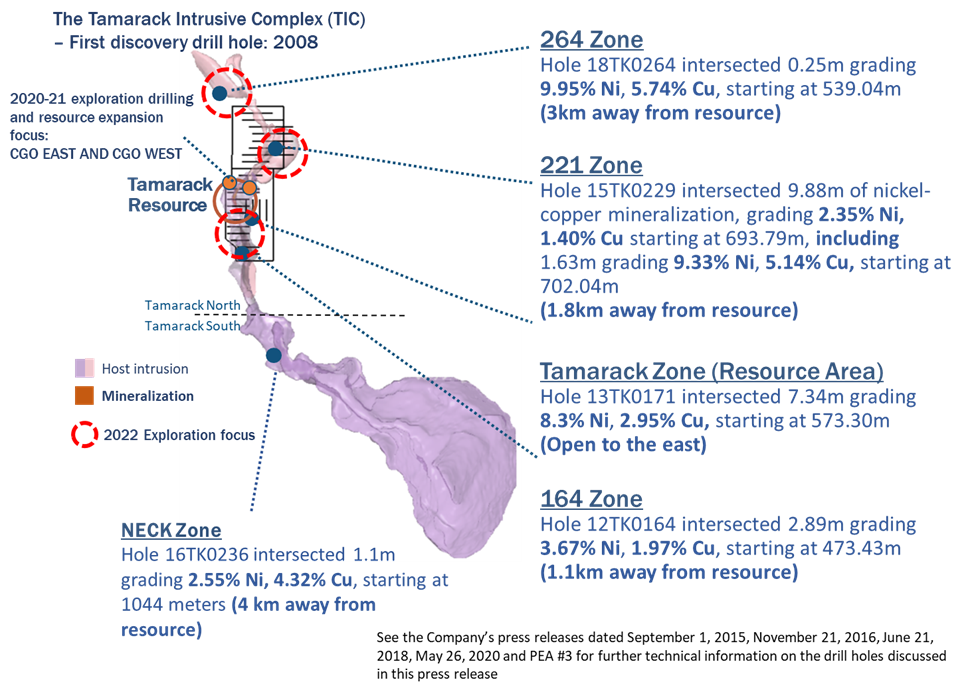

In 2022, in addition to an aggressive infill drill program to progress the Tamarack Nickel Project towards its pre-feasibility study, the Talon team will also turn its focus to a larger area of the Tamarack Intrusive Complex with the singular objective to find additional economically viable nickel and copper massive sulphide mineralization to demonstrate that Tamarack is a nickel-copper ‘district’. Talon intends on expanding the exploration within three areas of high priority in 2022 that are marked by high-grade assays:

- 264 Zone: Drill hole 18TK0264 intersected 0.25 meters of massive sulphide grading 9.95% Ni, 5.74% Cu at 539.04 meters depth approximately 3 kilometers (1.8 miles) northwest of the Tamarack Zone (Resource Area) (see Figure 1);

- 221 Zone: Drill Hole 15TK0229 intersected 9.88 meters of nickel-copper mineralization grading 2.35% Ni, 1.40% Cu starting at 693.79 meters, including 1.63 meters of massive sulphide grading 9.33% Ni, 5.14% Cu at 702.04 meters depth approximately 2 kilometers (1.2 miles) northeast of the Tamarack Zone (Resource Area) (see Figure 1); and

- 164 Zone: Drill Hole 12TK0164 intersected 2.89 meters of massive sulphide grading 3.67% Ni; 1.97% Cu at 473.43 meters depth approximately 1 kilometer (0.6 miles) south of the Tamarack Zone (Resource Area) (see Figure 1).

During the first half of 2022, Talon expects to finish exploration drilling around the margins of the Tamarack Zone (Resource Area), while the geophysics team conducts further electromagnetic surveying and the new Cross-Hole Tomography imaging to refine the targets listed above. Thereafter, drill rigs will be deployed in the subsequent months to drill the massive sulphide targets.

Talon has demonstrated that successfully located new zones of massive sulphides at the Tamarack Nickel Project requires an iterative process of geophysical surveying followed by precision drilling of the targets integrated with other supporting data. This allows small zones of high-grade massive sulphides to be traced to large bodies of nickel and copper rich mineralization. Talon will continue to use its low-cost exploration techniques and in-house team with the objective of finding the next nickel-copper resource in the Tamarack Intrusive Complex.

Figure 1: Locations of exploration focus in 2022 along the Tamarack Intrusive Complex

Corporate Update

Talon is pleased to announce that it has established an at-the-market equity program (the “ATM Program”) that allows the Company to issue and sell up to C$25 million of common shares of the Company (the “Common Shares”) from treasury to the public from time to time, at the Company’s discretion.

“The US government and US auto leaders are prioritizing the domestic EV battery supply chain as a matter of national priority. In our conversations with US officials and potential customers in the EV battery supply chain, it is clear that there is strong interest in additional domestic supply for battery grade nickel,” said Sean Werger, President of Talon. “The Talon exploration team has shown that the Tamarack Intrusive Complex has the potential to be a crucial source of carbon neutral domestic nickel for US battery manufacturing. Today’s announcement that we have established an ATM Program provides us with additional capital raising flexibility to ensure that we have the resources to meet the US battery priority.”

Any Common Shares issued pursuant to the ATM Program will be sold through the Toronto Stock Exchange (the “TSX”) or any other “marketplace” as defined under applicable securities laws, at the prevailing market price at the time of sale and, as such, prices may vary among purchasers during the period of the ATM Program. Sales under the ATM Program will be commenced at the Company’s discretion, and the net proceeds of any sales of Common Shares under the ATM Program, if any, will be used for general corporate purposes and working capital needs.

Distributions of the Common Shares through the ATM Program will be made pursuant to the terms of an equity distribution agreement (the “Distribution Agreement”) dated December 16, 2021 entered into among TD Securities Inc., BMO Capital Markets, Paradigm Capital Inc. and Sprott Capital Partners LP, as agents (collectively, the “Agents”) and the Company.

The volume and timing of distributions under the ATM Program, if any, will be determined at the Company’s sole discretion. The Company is not obligated to make any sales of Common Shares under the ATM Program. The ATM Program will be effective until the earlier of the issuance and sale of all of the Common Shares issuable pursuant to the ATM Program and December 31, 2022, unless terminated prior to such date by the Company or the Agents in accordance with the Distribution Agreement.

The ATM Program is being established pursuant to a prospectus supplement dated December 16, 2021 (the “Prospectus Supplement”) to the Company’s base shelf prospectus dated December 7, 2021 (the “Base Shelf Prospectus”) filed with the securities commissions in each of the provinces and territories of Canada. The Prospectus Supplement, the Base Shelf Prospectus, and the Distribution Agreement are available on the Company’s profile on SEDAR at www.sedar.com. Alternatively, the Agents will send copies of such documents to investors upon request by contacting: (i) TD Securities Inc., attn: Symcor, NPM, 1625 Tech Avenue, Mississauga, Ontario, L4W 5P5 or by email at sdcconfirms@td.com or by phone at 289-360-2009; or (ii) BMO Capital Markets, Brampton Distribution Centre C/O The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2 or by telephone at (905) 791-3151 Ext 4312 or by email at torbramwarehouse@datagroup.com. The ATM Program remains subject to final acceptance by the TSX.

The Common Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Common Shares in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Quality Assurance, Quality Control and Qualified Persons

Please see the technical report entitled “NI 43-101 Technical Report Updated Preliminary Economic Assessment (PEA) #3 of the Tamarack North Project – Tamarack, Minnesota” with an effective date of January 8, 2021 prepared by independent “Qualified Persons” (as that term is defined in National Instrument 43-101 (“NI 43-101”) Leslie Correia (Pr. Eng), Andre-Francois Gravel (P. Eng.), Tim Fletcher (P. Eng.), Daniel Gagnon (P. Eng.), David Ritchie (P. Eng.), Oliver Peters (P. Eng.), Volodymyr Liskovych (P.Eng.), Andrea Martin (P. E.) and Brian Thomas (P. Geo.) for information on the QA/QC, analytical and testing procedures at the Tamarack Nickel Project. Copies are available on the Company’s website (www.talonmetals.com) or on SEDAR at (www.sedar.com). The laboratory used is ALS Minerals who is independent of the Company.

Lengths are drill intersections and not necessarily true widths. True widths cannot be consistently calculated for comparison purposes between holes because of the irregular shapes of the mineralized zones. Drill intersections have been independently selected by Talon. Drill composites have been independently calculated by Talon. The geological interpretations in this news release are solely those of the Company. The locations and distances highlighted on all maps in this news release are approximate.

Dr. Etienne Dinel, Vice President, Geology of Talon, is a Qualified Person within the meaning of NI 43-101. Dr. Dinel is satisfied that the analytical and testing procedures used are standard industry operating procedures and methodologies, and he has reviewed, approved and verified the technical information disclosed in this news release, including sampling, analytical and test data underlying the technical information.

About Talon

Talon is a TSX-listed base metals company in a joint venture with Rio Tinto on the high-grade Tamarack Nickel-Copper-Cobalt Project located in central Minnesota. Talon has an earn-in to acquire up to 60% of the Tamarack Nickel Project. The Tamarack Nickel Project comprises a large land position (18km of strike length) with numerous high-grade intercepts outside the current resource area. Talon is focused on expanding its current high-grade nickel mineralization resource prepared in accordance with NI 43-101; identifying additional high-grade nickel mineralization; and developing a responsible processing capability in the United States. Talon has a well-qualified exploration and mine management team with extensive experience in project management.

For additional information on Talon, please visit the Company’s website at www.talonmetals.com/

Media Contact:

Todd Malan

1-(202)-714-8187

malan@talonmetals.com

Investor Contact:

Sean Werger

1-(416)-361-9636 x102

werger@talometals.com

Forward-Looking Statements

This news release contains certain “forward-looking statements”. All statements, other than statements of historical fact that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Such forward-looking statements include statements relating to progressing a pre-feasibility study on the Tamarack Nickel Project; strategies in respect of exploration programs; potential discoveries of additional economically viable nickel and copper massive sulphide mineralization; the timing and results of the exploration program, including assay results, grades, geophysical results and drilling plans; an increase to the size and extent of the known nickel and copper mineral resource; the timing and results of a new resource estimate; the Tamarack Intrusive Complex having the potential to be a crucial source of carbon neutral domestic nickel for US battery manufacturing, and other statements relating to the EV battery supply chain in the US; issuances of Common Shares under the ATM Program; the use of proceeds, if any, raised from the ATM Program; and the final acceptance by the TSX of the ATM Program. Forward-looking statements are subject to significant risks and uncertainties and other factors that could cause the actual results to differ materially from those discussed in the forward-looking statements, including but not limited to those risks outlined in the Prospectus Supplement, the Base Shelf Prospectus, and the documents incorporated by reference therein. Even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.