MEDIA ADVISORY

News Release

TSX:TLO

TALON METALS DISCUSSES A TRANSFORMATIONAL YEAR AHEAD FOR THE TAMARACK NICKEL PROJECT

Road Town, Tortola, British Virgin Islands (December 21, 2020) – Talon Metals Corp. (“Talon” or the “Company”) (TSX:TLO) is pleased to provide an update on the Tamarack Nickel-CopperCobalt Project (“Tamarack Nickel Project”), located in Minnesota, USA. The Tamarack Nickel Project comprises the Tamarack North Project and the Tamarack South Project.

Message from the President and CEO

On behalf of Talon, we would like to thank our valued team members for safely and consistently going the extra mile everyday at the Tamarack Nickel Project amidst the COVID-19 pandemic. Our priority is the safety of our people and our community, and we thank you all for taking extra precautions in all that we do.

We also wish to sincerely thank our shareholders and the Tamarack community for their loyal support over the course of the year.

With the Company’s share price increasing more than fourfold (since March 30, 2020), the year 2020 will definitely be a year to remember. While Talon has been largely unaffected, our thoughts go out to all those who have been negatively impacted by COVID-19.

Talon continues to be laser focussed on its strategy of getting the Tamarack Nickel Project into production effectively and responsibly as we move towards being the single source of battery grade Green NickelTM for an integrated domestic (USA made) supply chain. Given that the Tamarack Nickel Project is a (rare) high-grade nickel sulphide deposit, the USA now has the opportunity to become a low cost and green producer of high energy density nickel-based batteries.

Presently, there is but one producing nickel mine within the USA, which is expected to close around 2025. After that, the Tamarack Nickel Project will be the only currently known potential source for high-grade nickel within the USA. Given the predicted nickel deficit post-2025, we believe the Tamarack Nickel Project is ideally positioned to be in the “right place at the right time”.

Significant Progress Made in 2020

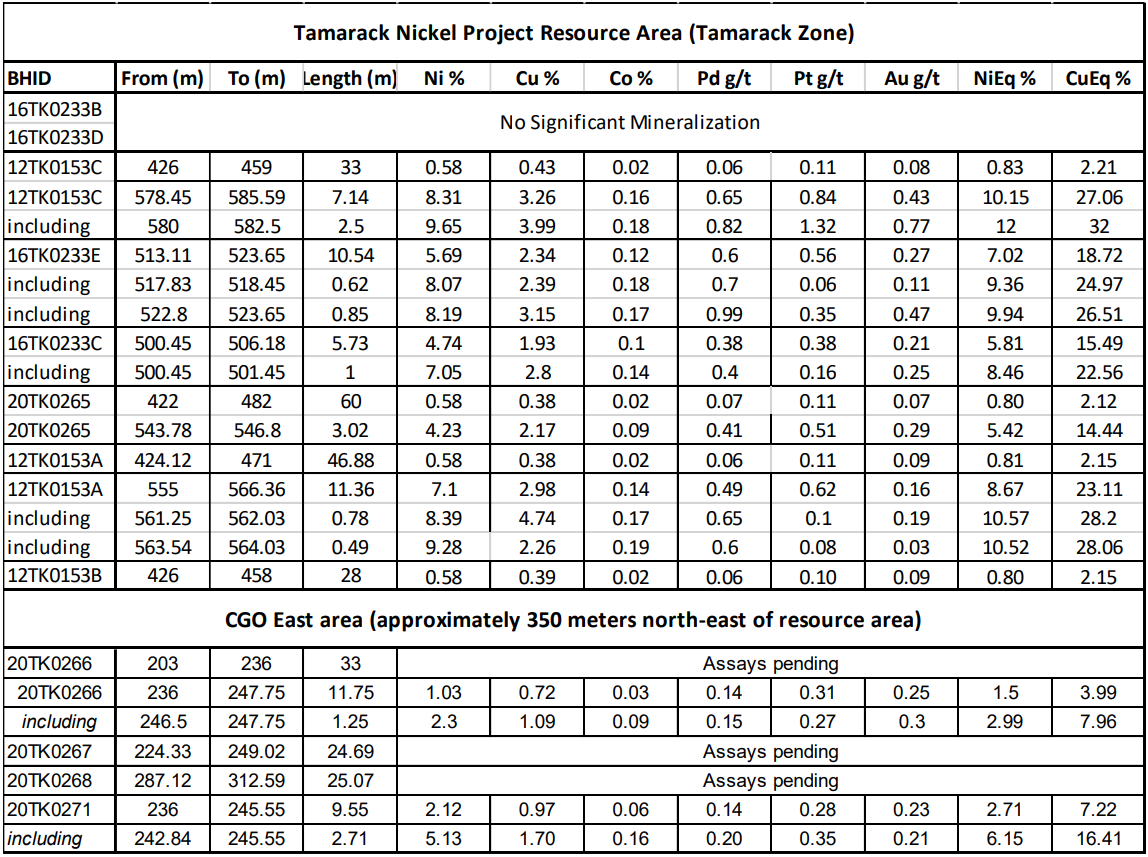

The year 2020 commenced with Talon kicking off its very first drill program as Operator of the Tamarack Nickel Project since taking over operatorship from Kennecott Exploration Company (part of the Rio Tinto group) in late 2019. Over the course of 2020, Talon’s drill programs focused primarily on drilling more massive sulphide mineralization within the Company’s mineral resource area (known as the Tamarack Zone) and stepping 350 meters outside of the Tamarack Nickel Project’s resource area in a new zone (known as CGO East). For a summary of the Company’s drill results, please see Table 1 below.

The drill programs from 2020 demonstrate Talon’s ability to hit drill targets with precision and under budget. To this end, through a number of innovative steps the Company has been able to significantly reduce its overall drill cost per meter, enabling the Company to drill much more for significantly less. With our 2021 budget, our goal is to drill between 25,000 and 30,000 meters.

The Company has also deployed the latest geophysical equipment with substantially higher resolution and consequently, drilling success.

Beyond drilling and geophysics, in March 2020 the Company released a positive Preliminary Economic Assessment (“PEA”), which was based on only a portion of the Tamarack Nickel Project’s total resource (covering only resources for which metallurgical test results were available at that time). Despite being a subset of the total resource, the PEA resulted in a strong after-tax project NPV of US$291 million and after-tax IRR of 36% (at base case metal price assumptions). The PEA demonstrates that the Tamarack Nickel Project is economically robust even as it stands today and even at low nickel prices (see the Company’s press release dated March 5, 2020). Other highlights from the PEA include low C1 cost of US$2.67 per lb of nickel in concentrate; high nickel and copper grades, with excellent metallurgical recoveries; and low CAPEX.

Since the issuance of the PEA, the Company has successfully completed a metallurgical test program that confirmed the robustness of its simplified flowsheet, which can treat the entire indicated and inferred resource at the Tamarack Nickel Project (see the Company’s press release dated August 31, 2020). Hydrometallurgical flowsheet development was also commenced with the goal of producing nickel sulphates at the Tamarack Nickel Project. The Company therefore plans to issue a further updated PEA in early 2021. This new PEA is a key milestone for the Company, as it will compare the economics of the Tamarack Nickel Project in the event the nickel concentrates produced from the project are used to produce refined nickel powders for the electric vehicle market, nickel sulphates for the electric vehicle market, or nickel for the stainless steel market.

The Year Ahead

The year ahead is expected to be the most exciting in Talon’s history. With the capital that the Company recently raised, we have a strong treasury of approximately C$16 million and consequently, the Company is funded to carry out its 2021 plans.

The key expected catalysts for value creation in 2021 are as follows:

1. Growing the Tamarack Nickel Project’s Current Resource to the North, while Aiming

to Reduce the Timeline to Production:

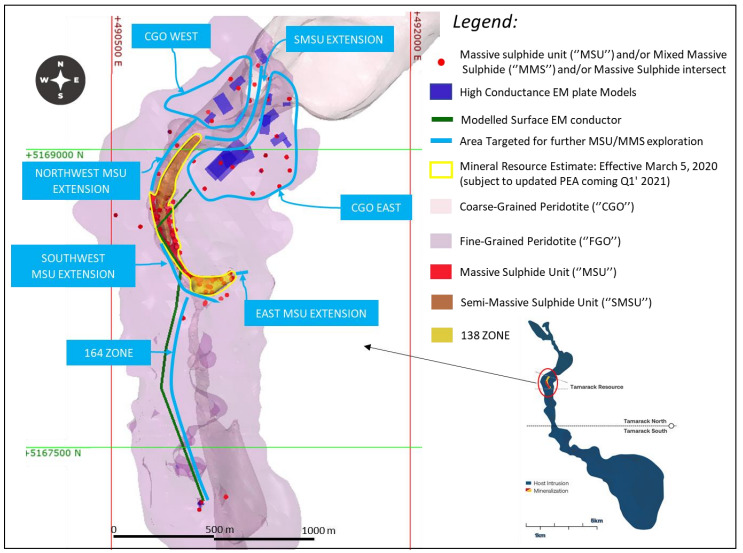

- The Company plans to investigate a possible 550 meter extension of the coarsegrained disseminated sulphide mineralization starting at the most northern part of the Tamarack Nickel Project’s resource area. This potential sulphide mineralization is predicted to be shallower than the mineralization within the Tamarack Nickel Project’s current resource area, and as such, could potentially reduce the timeline to production at the Tamarack Nickel Project (see Figure 1, SMSU Extension).

- The Company recently intercepted high-grade massive sulphide mineralization below a thicker zone of disseminated sulphides to the north-east of the Tamarack Nickel Project’s current resource area (see Figure 1, CGO East), and plans to follow this approximate 800 meter trend. The mineralization is shallow and could therefore also reduce the timeline to production at the Tamarack Nickel Project.

- The Company plans to follow-up on previously intercepted mixed massive sulphide mineralization approximately 150 meters to the north-west of the Tamarack Nickel Project’s current resource area (see Figure 1, CGO West). This mineralization could potentially extend for an additional 250 meters (i.e., 400 meters north-west of the Tamarack Nickel Project’s current resource area).

2. Investigating Possible Extensions of the High-Grade Massive Sulphide Unit within

the Tamarack Nickel Project’s Current Resource Area:

- The Company has modelled a strong Borehole Electro-Magnetic (“BHEM”) conductor east of the southern part of the massive sulphide unit (see Figure 1, East MSU Extension), and this is expected to be drilled in January 2021.

- Further geophysical work to define drill targets based on the 1 km modeled surface electromagnetic conductor between the massive sulphides in the Tamarack Nickel Project’s current resource area and an area south of the Tamarack Nickel Project’s resource area (known as the 164 Zone) is ongoing with the aim of prioritizing drill targets over this vast area (see Figure 1, 164 Zone).

3. Unlocking Exploration Potential Across the Remainder of the 18 km Tamarack Intrusive Complex (TIC) – Cost Effectively:

- The Company’s goal is to cost effectively make more discoveries along the approximate 18 km Tamarack Intrusive Complex by using the Tamarack Nickel Project’s current resource area as a “laboratory” for testing geophysical techniques that can potentially detect sulphide mineralization from surface and/or with a limited number of drill holes.

- The upgrading of our geophysical systems has already led to successfully drilling highgrade massive sulphides to the east of the Tamarack Nickel Project’s current resource area. The Company therefore continues to consider and test geophysical techniques to: (a) reduce the number of infill drill holes; and (b) effectively follow-up on high-grade massive sulphide intercepts to the north and south of the Tamarack Nickel Project’s current resource area.

Figure 1: Illustration of potential exploration targets during 2021 drill program at the Tamarack

Nickel Project, with a total of seven areas to explore

4. Moving Towards A Pre-Feasibility Study:

- The Company’s 2021 budget includes infill drilling within the Tamarack Nickel Project’s current resource area, as well as the areas to the north and to the east of the resource area should exploration be successful, with the goal of getting the Tamarack Nickel Project ready for a Pre-Feasibility Study (see Figure 1, Mineral Resource Estimate). The Company plans to start this program in the second quarter of 2021.

- The Company plans to continue metallurgical test work towards producing nickel sulphates or potentially refined nickel powders from the Tamarack Nickel Project’s nickel concentrates. By completing this work, we hope to demonstrate that nickel concentrates from the Tamarack Nickel Project can potentially be a catalyst to establishing a domestic (USA made) nickel supply chain for electric vehicle (EV) batteries.

- The Company will also continue its environmental baseline study work, and plans to conduct additional environmental studies that will help to make informed decisions about future work plans as the project progresses towards permitting. These studies include several investigations of CO2 sequestration.

In summary, we expect 2021 to be a foundational year for Talon, as we aim to:

- Publish an updated PEA in early 2021 – this PEA will compare the economics of the Tamarack Nickel Project in the event the nickel concentrates produced from the project are used to produce refined nickel powder for the electric vehicle market, nickel sulphates for the electric vehicle market, or nickel for the stainless steel market.

- Drill 25,000 to 30,000 meters focussed on both resource expansion and infill drilling of the Tamarack Nickel Project’s current resource

- Continue to test and deploy various geophysical techniques to cost effectively followup on high-grade massive sulphide intercepts several kilometers away from the Tamarack Nickel Project’s current resource area with the goal of making new discoveries along the 18 km Tamarack Intrusive Complex.

- Continue with flowsheet development to potentially produce refined nickel powders or nickel sulphates from nickel concentrates, with the goal of becoming a catalyst for establishing an integrated (USA made) low-cost domestic Green NickelTM supply chain from mine to battery. Flowsheet development will include CO2 sequestration studies.

- Collect a large amount of data and perform continual analyses to prepare for a Prefeasibility and Definitive Feasibility Study.

- Finally, the Company is considering a potential listing on a major US stock exchange

during the latter part of 2021.

On behalf of the entire Talon team, we would like to wish everyone a happy and healthy 2021. As always, if you have any questions, please feel free to reach out to Sean Werger, President at 416-500-9891 or swerger@talonmetals.com.

Table 1: Summary of 2020 Drill Holes at the Tamarack Nickel Project

Length refers to drill hole length and not True Width.

True Width is unknown at the time of publication.

All samples were analysed by ALS Minerals. Nickel, copper, and cobalt grades were first analysed by a 4-acid digestion and ICP AES (ME-MS61). Grades reporting greater than 0.25% Ni and/or 0.1% Cu, using ME-MS61, trigger a sodium peroxide fusion with ICP-AES finish (ICP81). Platinum, palladium and gold are initially analyzed by a 50g fire assay with an ICP-MS finish (PGM-MS24). Any samples reporting >1g/t Pt or Pd trigger an over-limit analysis by ICP-AES finish (PGM-ICP27) and any samples reporting >1g/t Au trigger an over-limit analysis by AAS (Au-AA26).

NiEq% = Ni%+ Cu% x $3.00/$8.00 + Co% x $12.00/$8.00 + Pt [g/t]/31.103 x $1,300/$8.00/22.04 + Pd [g/t]/31.103 x $700/$8.00/22.04 + Au [g/t]/31.103 x $1,200/$8.00/22.04

CuEq% = Cu%+ Ni% x $8.00/$3.00 + Co% x $12.00/$3.00 + Pt [g/t]/31.103 x $1,300/$3.00/22.04 + Pd [g/t]/31.103 x $700/$3.00/22.04 + Au [g/t]/31.103 x $1,200/$3.00/22.04

Quality Assurance, Quality Control and Qualified Persons

Please see the technical report entitled “NI 43-101 Technical Report Updated Preliminary Economic Assessment (PEA) of the Tamarack North Project – Tamarack, Minnesota” with an effective date of March 12, 2020 prepared by independent “Qualified Persons” (as that term is defined in National Instrument 43-101 (“NI 43-101”) Leslie Correia (Pr. Eng), Andre-Francois Gravel (P. Eng.), Tim Fletcher (P. Eng.), Daniel Gagnon (P. Eng.), David Ritchie (P. Eng.), Oliver Peters (P. Eng.), Christine Pint (P.G.) and Brian Thomas (P. Geo.) for information on the QA/QC, analytical and testing procedures at the Tamarack Nickel Project. Copies are available on the Company’s website (www.talonmetals.com) or on SEDAR at (www.sedar.com). The laboratory used is ALS Minerals who is independent of the Company.

Lengths are drill intersections and not necessarily true widths. True widths cannot be consistently calculated for comparison purposes between holes because of the irregular shapes of the mineralized zones. Drill intersections have been independently selected by Talon. Drill composites have been independently calculated by Talon. The geological interpretations in this news release are solely those of the Company.

The locations and distances highlighted on all maps in this news release are approximate.

Dr. Etienne Dinel, Vice President, Geology of Talon, is a Qualified Person within the meaning of NI 43-101. Dr. Dinel is satisfied that the analytical and testing procedures used are standard industry operating procedures and methodologies, and he has reviewed, approved and verified the technical information disclosed in this news release, including sampling, analytical and test data underlying the technical information.

About Talon

Talon is a TSX-listed base metals company in a joint venture with Rio Tinto on the high-grade Tamarack Nickel-Copper-Cobalt Project located in Minnesota, USA, comprised of the Tamarack North Project and the Tamarack South Project. Talon has an earn-in to acquire up to 60% of the Tamarack Project. The Tamarack Nickel Project comprises a large land position (18km of strike length) with numerous high-grade intercepts outside the current resource area. Talon is focused on expanding its current high-grade nickel mineralization resource prepared in accordance with NI 43-101; identifying additional high-grade nickel mineralization; and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry. Talon has a well-qualified exploration and mine management team with extensive experience in project management.

For additional information on Talon, please visit the Company’s website at www.talonmetals.com or contact:

Sean Werger

President

Talon Metals Corp.

Tel: (416) 361-9636 x102

Email: werger@talonmetals.co

Forward-Looking Statements

This news release contains certain “forward-looking statements”. All statements, other than statements of historical fact that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Such forward-looking statements include statements relating to the timing and results of the exploration program, including assay results, grades, geophysics and drilling plans; getting the Tamarack Nickel Project into production effectively and responsibly; the opportunity to become one of the lowest and greenest producers of high energy density nickel-based batteries; the Company’s plans to complete and issue a further updated PEA early in early 2021; growing the Company’s current resource to the north, while aiming to reduce the timeline to production; possible extensions of the high-grade massive sulphide unit within the Company’s current resource area: the potential to cost effectively make more discoveries along the approximate 18 km Tamarack Intrusive Complex; getting the Tamarack Nickel Project ready for a Pre-Feasibility Study; plans for additional environmental baseline work and studies; the consideration of a potential listing on a major US stock exchange during the latter part of 2021; and the Company’s proposed budget and expenditures in 2021. Forward-looking statements are subject to significant risks and uncertainties and other factors that could cause the actual results to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forwardlooking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

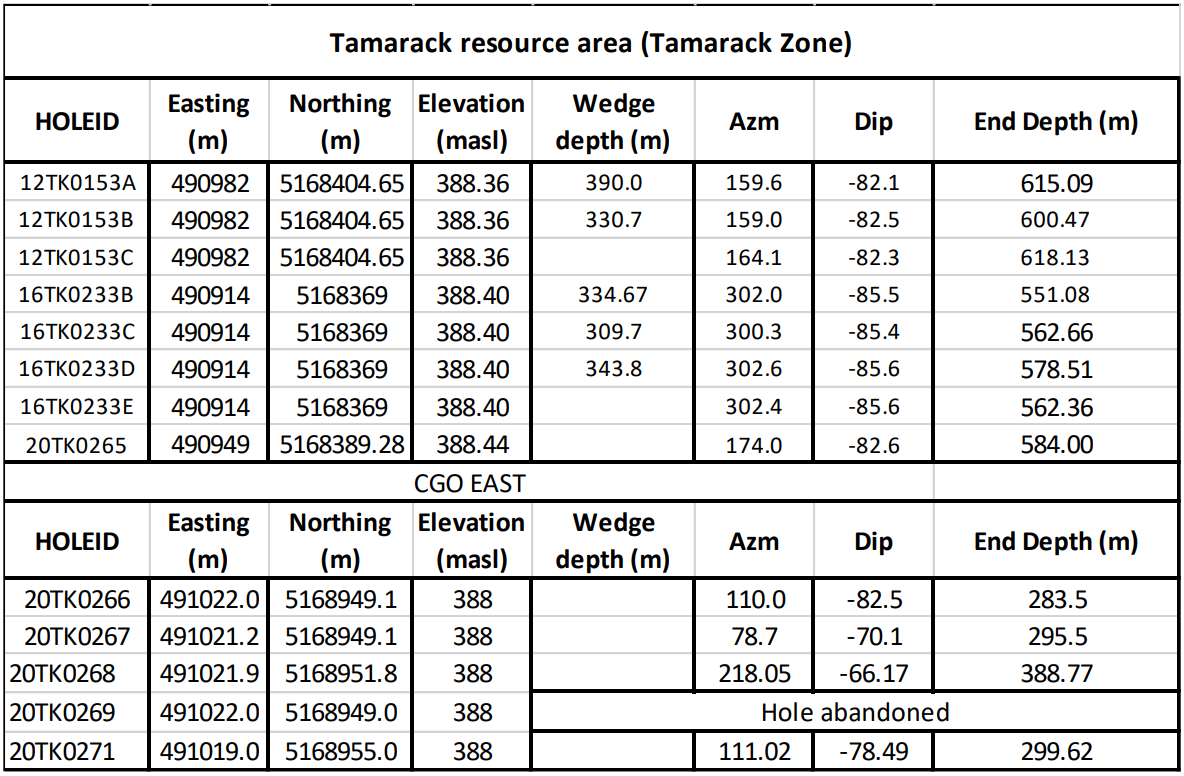

Table 2: Collar table 2020 exploration program

Collar coordinates are UTM Zone 15N, NAD83.

Azimuth and Dip are downhole survey averages for the

hole.