MEDIA ADVISORY

News Release

TSX:TLO

TALON METALS ANNOUNCEMENT: INCREASE IN THROUGHPUT AND MINE LIFE EXPECTED AT TAMARACK AS A RESULT OF POSITIVE METALLURGICAL TEST RESULTS

Road Town, Tortola, British Virgin Islands (July 8, 2020) – Talon Metals Corp. (“Talon” or the “Company”) (TSX:TLO) is pleased to provide an update on the Tamarack Nickel-Copper-Cobalt project (“Tamarack Project”), located in Minnesota, USA. The Tamarack Project comprises the Tamarack North Project and the Tamarack South Project.

Highlights

- The Company’s Updated Preliminary Economic Assessment (“PEA”) (with an effective date of March 12, 2020)1 included only 9 million tonnes of material in the proposed mine plan. More specifically, 3.1 million tonnes of material were excluded from the Company’s proposed mine plan, as development of a representative flowsheet was still in progress by the Company.

- Since March 12, 2020, flotation optimization has been conducted on a composite sample grading 1.61% Ni and 0.96% Cu. This is considered representative of the mineralization at the Tamarack

- The flowsheet development has been successful: Flotation selectivity was unaffected by the addition of the material representative of the remaining 3.1 million tonnes of

- An updated mine plan and economic analysis is now underway by the Company to reflect the positive results from the metallurgical test

- The Company is presently conducting a Locked Cycle Test with the intention of using the concentrates to commence downstream flowsheet development with the goal of establishing an integrated nickel sulphate complex at the Tamarack Project. Such a complex is expected to be strategic to US and European electric vehicle

- Based upon the Company’s recent metallurgical test results, the Company is optimistic that the large body of mineralization above the high-grade massive sulphide unit (the 138 Zone) can be included in future mine

1 NI 43-101 Technical Report Updated Preliminary Economic Assessment (PEA) of the Tamarack North Project – Tamarack, Minnesota” with an effective date of March 12, 2020. It is available on SEDAR at www.sedar.com.

“The metallurgical performance of the Tamarack mineralization continues to excite”, said Oliver Peters, Talon’s metallurgical consultant. “A simplified flowsheet has now been developed to treat the entire resource from the Tamarack Project. Results are excellent and most certainly better than expected. We will now commence hydrometallurgical flowsheet development with the goal of producing nickel sulphates in the United States. The ultimate goal is to create a nickel sulphate complex at Tamarack that will be one of the lowest cost producers globally.”

“In May 2019, at the Benchmark Minerals Summit in Washington D.C. (Securing 21st Century

U.S. Supply Chains for EVs and Energy Storage), the Company presented a vision to collapsing the value chain for producing nickel sulphates or precursor, which are key inputs into lithium-ion batteries used in electric vehicles and renewable energy storage: We are rapidly moving towards the realization of this vision”, said Henri van Rooyen, Talon CEO.

Technical Discussion

Selection of Life-of-Mine Composite

In late 2019, two flotation composites were generated to determine the impact of including the 138 Zone in the life-of-mine mill feed (see Figure 1). The two composites comprised a life-of- mine composite with the SMSU/MSU mineralization (semi-massive sulphide unit and massive sulphide unit mineralization) and the 138 Zone (total of 8.02 million tonnes of material) and a life- of-mine composite without the 138 Zone (total of only 5.32 million tonnes of material). A total of 475 drill hole intervals were selected with careful consideration of grade and spatial distribution to produce representative resource composites.

A series of rougher and cleaner flotation tests were completed on the two composites and the results were analyzed to determine if the 138 Zone had a detrimental impact on the flotation response of the SMSU and MSU mineralization.

While the rougher recovery for the 138 Zone mineralization of 80.4% Ni and 79.2% Cu was lower compared to the SMSU/MSU mineralization at 92.2% Ni and 94.8% Cu, the inclusion of the 138 Zone material did not result in an increased entrainment of gangue minerals. Hence, a decision was made to proceed with the process optimization program including the 138 Zone since it maximizes mineable metal units.

Process Optimization

The life-of-mine with 138 Zone composite was subjected to a process optimization program to produce separate Ni and Cu concentrates. The program culminated in a simple flowsheet consisting of a bulk rougher, two stages of bulk cleaning, a regrind, and a three-stage Cu/Ni separation circuit.

An open-circuit cleaner flotation test produced a Ni concentrate grading 10.2% Ni and 1.08% Cu and a Cu concentrate grading 30.1% Cu and 0.84% Ni. Both concentrates produced grades that are attractive for pyrometallurgical processing in Ni and Cu smelters, respectively.

The open-circuit Cu and Ni recovery into the Cu/Ni separation circuit was high at 84.4% for Cu and 80.0% for Ni. These values are expected to increase further during closed-circuit operation since circulating streams are treated as tailings in open-circuit tests.

Next Steps

A locked cycle flotation test is scheduled to be completed to simulate the closed-circuit performance of the proposed flowsheet and to produce approximately 3 kg of Ni concentrate for hydrometallurgical flowsheet development. Additional process optimization is planned for the next phase of flotation testing to evaluate flowsheet modifications that further improve concentrate grades and/or metal recoveries.

Drilling Update

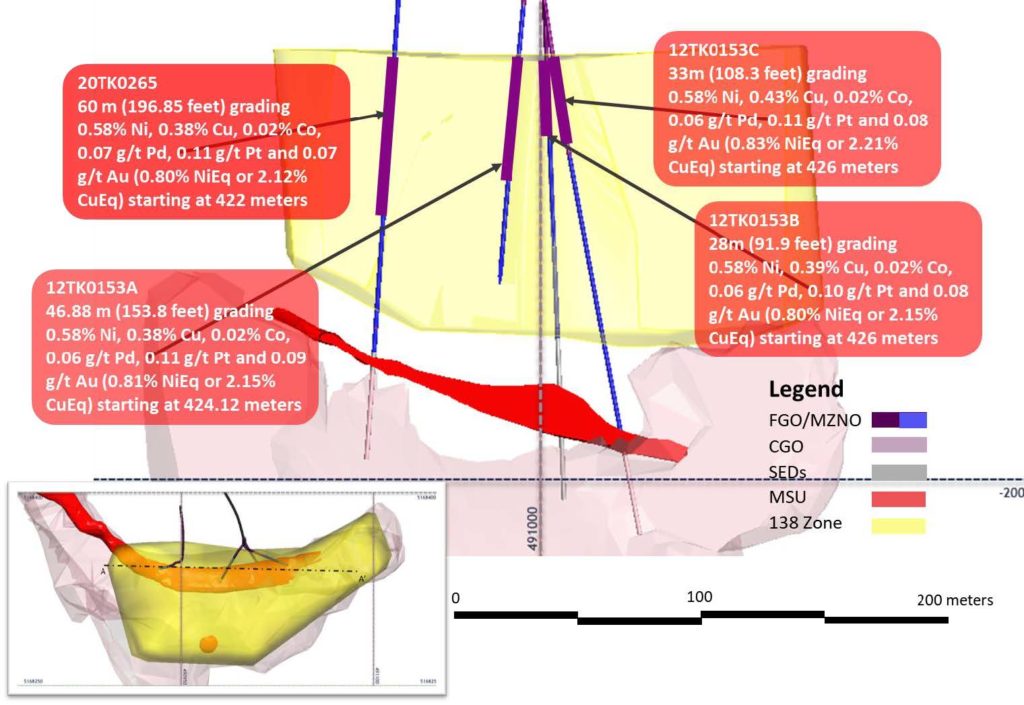

With limited additional costs, Talon drilled the edges of the 138 Zone during the January to March 2020 exploration program. The 138 Zone is a large body of mineralization above the high-grade massive sulphide unit. The results, listed below, are in line with the Company’s resource model:

- Drill hole 12TK0153C intersected 33 meters (108.3 feet) of disseminated sulphides grading 0.58% Ni, 0.43% Cu, 0.02% Co, 0.06 g/t Pd, 0.11 g/t Pt and 0.08 g/t Au (0.83% NiEq2 or 2.21% CuEq3), starting at 426 meters (see Figure 1 and Tables 1 and 2);

- Drill hole 12TK0153A intersected 46.88 meters (153.8 feet) of disseminated sulphides grading 0.58% Ni, 0.38% Cu, 0.02% Co, 0.06 g/t Pd, 0.11 g/t Pt and 0.09 g/t Au (0.81% NiEq or 2.15% CuEq), starting at 424.12 meters (see Figure 1 and Tables 1 and 2);

- Drill hole 20TK0265 intersected 60 meters (196.85 feet) of disseminated sulphides grading 0.58% Ni, 0.38% Cu, 0.02% Co, 0.07 g/t Pd, 0.11 g/t Pt and 0.07 g/t Au (0.80% NiEq or 2.12% CuEq), starting at 422 meters (see Figure 1 and Tables 1 and 2).

- Drill Hole 12TK0153B intersected 28 meters (91.9 feet) of disseminated sulphides grading 58% Ni, 0.39%Cu, 0.02% Co, 0.06 g/t Pd, 0.10 g/t Pt and 0.08 g/t Au (0.80% NiEq or 2.15% CuEq), starting at 426 meters (see Figure 1 and Tables 1 and 2).

2 Where used in this news release: NiEq% = Ni%+ Cu% x $3.00/$8.00 + Co% x $12.00/$8.00 + Pt [g/t]/31.103 x $1,300/$8.00/22.04 + Pd [g/t]/31.103 x $700/$8.00/22.04 + Au [g/t]/31.103 x $1,200/$8.00/22.04

3 Where used in this news release: CuEq% = Cu%+ Ni% x $8.00/$3.00 + Co% x $12.00/$3.00 + Pt [g/t]/31.103 x $1,300/$3.00/22.04 + Pd [g/t]/31.103 x $700/$3.00/22.04 + Au [g/t]/31.103 x $1,200/$3.00/22.04

FIGURE 1: SECTION OF THE 138 ZONE AREA (IN YELLOW), WHICH IS LOCATED WITHIN THE TAMARACK ZONE (RESOURCE AREA). THIS FIGURE SHOWS THE LOCATION OF DRILL HOLES 12TK0153A, 12TK0153C, 12TK0153B AND 20TK0265. THE SMALL INSERT IN THE BOTTOM LEFT-HAND CORNER SHOWS THE LOCATION OF THE SECTION.

Based upon the Company’s recent metallurgical test results (discussed above), the Company is optimistic that the large body of mineralization above the high-grade massive sulphide unit (the 138 Zone) can be included in future mine plans.

Quality Assurance, Quality Control and Qualified Persons

Please see the technical report entitled “NI 43-101 Technical Report Updated Preliminary Economic Assessment (PEA) of the Tamarack North Project – Tamarack, Minnesota” with an effective date of March 12, 2020 prepared by independent “Qualified Persons” (as that term is defined in National Instrument 43-101 (“NI 43-101”) Leslie Correia (Pr. Eng), Andre-Francois Gravel (P. Eng.), Tim Fletcher (P. Eng.), Daniel Gagnon (P. Eng.), David Ritchie (P. Eng.), Oliver Peters (P. Eng.), Christine Pint (P.G.) and Brian Thomas (P. Geo.) for information on the QA/QC, analytical and testing procedures at the Tamarack Project. Copies are available on the Company’s website (www.talonmetals.com) or on SEDAR at (www.sedar.com). The laboratory used is ALS Minerals who is independent of the Company.

Lengths are drill intersections and not necessarily true widths. True widths cannot be consistently calculated for comparison purposes between holes because of the irregular shapes of the mineralized zones. Drill intersections have been independently selected by Talon. Drill composites have been independently calculated by Talon. The geological interpretations in this news release are solely those of the Company.

The locations and distances highlighted on all maps in this news release are approximate.

Mr. Oliver Peters, a Mineral Processing Engineer with Metpro Management Inc., is a Qualified Person within the meaning of NI 43-101. Mr. Peters is satisfied that the analytical and testing procedures used are standard industry operating procedures and methodologies, and he has reviewed, approved and verified the technical information disclosed in this news release, including sampling, analytical and test data underlying the technical information.

About Talon

Talon is a TSX-listed base metals company in a joint venture with Rio Tinto on the high-grade Tamarack Nickel-Copper-Cobalt Project located in Minnesota, USA, comprised of the Tamarack North Project and the Tamarack South Project. Talon has an earn-in to acquire up to 60% of the Tamarack Project. The Tamarack Project comprises a large land position (18km of strike length) with numerous high-grade intercepts outside the current resource area. Talon is focused on expanding its current high-grade nickel mineralization resource prepared in accordance with NI 43-101; identifying additional high-grade nickel mineralization; and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry. Talon has a well-qualified exploration and mine management team with extensive experience in project management.

For additional information on Talon, please visit the Company’s website at www.talonmetals.com or contact:

Sean Werger

President

Talon Metals Corp.

Tel: (416) 361-9636 x102

Email: werger@talonmetals.com

Forward-Looking Statements

This news release contains certain “forward-looking statements”. All statements, other than statements of historical fact that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Such forward-looking statements include statements relating to the representative nature of the metallurgical test results and the results of the simplified flowsheet’s use on a larger scale, future metallurgical testing, process optimization and results, the timing and results of an updated mine plan and economic analysis, the intention to using concentrates to commence downstream flowsheet development with the goal of establishing an integrated nickel sulphate complex at the Tamarack Project, the expectation that a nickel sulphate complex will be strategic to US and European electric vehicle manufacturers, and future exploration and results at the Tamarack Project. Forward-looking statements are subject to significant risks and uncertainties and other factors that could cause the actual results to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward- looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Table 1: Collar Locations of Drill Holes from January to March 2020 Exploration Program

HOLEID | Easting (m) | Northing (m) | Elevation (masl) | Wedge depth (m) | Azm | Dip | End Depth (m) |

12TK0153A | 490982 | 5168404.65 | 388.36 | 390.0 | 159.6 | -82.1 | 615.09 |

12TK0153B | 490982 | 5168404.65 | 388.36 | 330.7 | 159.0 | -82.5 | 600.47 |

12TK0153C | 490982 | 5168404.65 | 388.36 |

| 164.1 | -82.3 | 618.13 |

16TK0233B | 490914 | 5168369 | 388.40 | 334.67 | 302.0 | -85.5 | 551.08 |

16TK0233C | 490914 | 5168369 | 388.40 | 309.7 | 300.3 | -85.4 | 562.66 |

16TK0233D | 490914 | 5168369 | 388.40 | 343.8 | 302.6 | -85.6 | 578.51 |

16TK0233E | 490914 | 5168369 | 388.40 |

| 302.4 | -85.6 | 562.36 |

20TK0265 | 490949 | 5168389.28 | 388.44 |

| 174.0 | -82.6 | 584.00 |

Collar coordinates are UTM Zone 15N, NAD83.

Azimuth and Dip are downhole survey averages for the hole.

For daughter holes; collar coordinates and elevations are same as mother hole; approximate wedge depth given; azimith and dip are the survey averages below the wedge.

Table 2: Assay Results from Drill Holes from January to March 2020 Exploration Program (including new intervals with assays from holes 12TK0153C, 20TK0265, 12TK0153A and 12TK0153B)

BHID | From (m) | To (m) | Length (m) | % Cu | % Ni | % Co | Pd g/t | Pt g/t | Au g/t | % NiEq | % CuEq |

12TK0153C | 426 | 459 | 33 | 0.43 | 0.58 | 0.02 | 0.06 | 0.11 | 0.08 | 0.83 | 2.21 |

20TK0265 | 422 | 482 | 60 | 0.38 | 0.58 | 0.02 | 0.07 | 0.11 | 0.07 | 0.80 | 2.12 |

12TK0153A | 424.12 | 471 | 46.88 | 0.38 | 0.58 | 0.02 | 0.06 | 0.11 | 0.09 | 0.81 | 2.15 |

12TK0153B | 426 | 458 | 28 | 0.39 | 0.58 | 0.02 | 0.06 | 0.10 | 0.09 | 0.80 | 2.15 |

12TK0153C | 578.45 | 585.59 | 7.14 | 3.26 | 8.31 | 0.16 | 0.65 | 0.84 | 0.43 | 10.15 | 27.06 |

including | 580 | 582.5 | 2.5 | 3.99 | 9.65 | 0.18 | 0.82 | 1.32 | 0.77 | 12 | 32 |

16TK0233E | 513.11 | 523.65 | 10.54 | 2.34 | 5.69 | 0.12 | 0.6 | 0.56 | 0.27 | 7.02 | 18.72 |

including | 517.83 | 518.45 | 0.62 | 2.39 | 8.07 | 0.18 | 0.7 | 0.06 | 0.11 | 9.36 | 24.97 |

including | 522.8 | 523.65 | 0.85 | 3.15 | 8.19 | 0.17 | 0.99 | 0.35 | 0.47 | 9.94 | 26.51 |

16TK0233C | 500.45 | 506.18 | 5.73 | 1.93 | 4.74 | 0.1 | 0.38 | 0.38 | 0.21 | 5.81 | 15.49 |

including | 500.45 | 501.45 | 1 | 2.8 | 7.05 | 0.14 | 0.4 | 0.16 | 0.25 | 8.46 | 22.56 |

20TK0265 | 543.78 | 546.8 | 3.02 | 2.17 | 4.23 | 0.09 | 0.41 | 0.51 | 0.29 | 5.42 | 14.44 |

12TK0153A | 555 | 566.36 | 11.36 | 2.98 | 7.1 | 0.14 | 0.49 | 0.62 | 0.16 | 8.67 | 23.11 |

including | 561.25 | 562.03 | 0.78 | 4.74 | 8.39 | 0.17 | 0.65 | 0.1 | 0.19 | 10.57 | 28.2 |

including | 563.54 | 564.03 | 0.49 | 2.26 | 9.28 | 0.19 | 0.6 | 0.08 | 0.03 | 10.52 | 28.06 |

16TK0233B | No Significant Mineralization | ||||||||||

16TK0233D | |||||||||||

Length refers to drill hole length and not True Width. True Width is unknown at the time of publication.

All samples were analysed by ALS Minerals. Nickel, copper, and cobalt grades were first analysed by a 4-acid digestion and ICP AES (ME-MS61). Grades reporting greater than 0.25% Ni and/or 0.1% Cu, using ME-MS61, trigger a sodium peroxide fusion with ICP-AES finish (ICP81). Platinum, palladium and gold are initially analyzed by a 50g fire assay with an ICP-MS finish (PGM-MS24). Any samples reporting >1g/t Pt or Pd trigger an over-limit analysis by ICP-AES finish (PGM-ICP27) and any samples reporting >1g/t Au trigger an over- limit analysis by AAS (Au-AA26).

NiEq% = Ni%+ Cu% x $3.00/$8.00 + Co% x $12.00/$8.00 + Pt [g/t]/31.103 x $1,300/$8.00/22.04 + Pd [g/t]/31.103 x $700/$8.00/22. 04 + Au [g/t]/31.103 x $1,200/$8.00/22.04

CuEq% = Cu%+ Ni% x $8.00/$3.00 + Co% x $12.00/$3.00 + Pt [g/t]/31.103 x $1,300/$3.00/22.04 + Pd [g/t]/31.103 x $700/$3.00/22.04 + Au [g/t]/31.103 x $1,200/$3.00/22.04